Agronomist notes

Hello Reader,

Happy New Year! I hope your holidays were cheery and restful. Enjoying the mild temperatures on the local outdoor rink with my future NHLers was a highlight of mine.

The other day we finished selling all of our barley and I’m pleased to say our good land went 106 bu/ac and poorer land went 82 bu/ac. Having lost 10% or more from excessive rain, we are not complaining! We’ve yet to haul in the remaining 75% of our canola but our averages look promising there as well. People ask if CTF is working for us and all I have to say is that we’re definitely on the right, um, track.

The other day we finished selling all of our barley and I’m pleased to say our good land went 106 bu/ac and poorer land went 82 bu/ac. Having lost 10% or more from excessive rain, we are not complaining! We’ve yet to haul in the remaining 75% of our canola but our averages look promising there as well. People ask if CTF is working for us and all I have to say is that we’re definitely on the right, um, track.

Some interesting news on the post-CWB front are the basis levels for new crop wheat. It’s interesting to note that basis levels are roughly $0.80/bu for new crop wheat where CWB basis levels have been $1.38/bu historically. That means the former middle man cost us $0.58/bu to market our grain. To some of my clients that’s over $100,000 year in wheat marketing costs alone. Let’s turn the page on that chapter.

This week we’ll discuss growing CPS versus HRS wheat in 2012 with tips on CPS wheat production. Next, we’ll look into crop options for 2012 with the top five most profitable crops to grow this year. Last we’ll look into boosting wheat proteins with liquid urea given the protein premiums offered for new crop wheat. We’ll finish with fundamental and technical grain market news.

Thanks for joining me for Volume 7 of Beyond Agronomy News. I anticipate a great year ahead.

“Bearish like markets are strong in the morning and sell off in the day. Bull markets are the opposite.” Andy All_inEquities via twitter

Hard Red Spring Wheat vs. Canadian Prairie Spring Wheat in 2012

Deciding what to grow based on grade & protein

I’ve been wracking my brain trying to decide whether to grow HRS wheat or CPS wheat in 2012. The criteria I’ve put together are simple: 1) can you grow wheat with protein above 12.5% consistently, and 2) can you produce a No. 2 grade or better each year. If you answer no to one or both of these questions then maybe you should look at CPS for 2012. Here’s why.

Steve’s quick math

No. 2 11.5% HRS: 60 bu/ac × $5.80 = $348.00/ac

No. 1 13.5% HRS: 60 bu/ac × $7.80 = $468.00/ac

Risk spread: $468.00/ac - $348.00/ac = $120.00/ac

No. 2 11.5% CPS: 70 bu/ac × $6.30 = $441.00/ac

No. 1 11.5% CPS: 70 bu/ac × $6.80 = $476.00/ac

Risk spread: $476.00/ac - $441.00/ac = $35.00/ac

If you look at the protein spread between a No. 1 HRS 13.5% versus No. 1 HRS 11.5%, you are potentially risking $120.00 an acre in revenue should your protein not meet spec, even if it grades a No. 1. If you look at the spread between a No. 1 CPS 11.5% and No. 2 CPS 11.5%, you’re risking $35.00 an acre in revenue if it doesn’t meet spec. Even if the CPS went feed, where values hover around $5.30 per bushel, you’d still generate $23.00 an acre more than a No. 2 HRS 11.5%.

Based on experience and conversations with regular CPS growers, you can comfortably bank on a 15-20% yield bump with CPS over HRS wheat so long as you follow up with the right agronomy. Here are some considerations if you decide to grow CPS:

- Yield potential may not be realized on sandy or coarse textured soils so a 15-20% yield advantage over HRS may not be realistic.

- CPS wheats tend to have less tolerance to disease than HRS wheat varieties. A fungicide is a must in the program and possibly two applications in a wet year with high disease and decent yield potential. Stick to premium fungicides like Folicur, Prosaro, Headline or Quilt. Tilt and Stratego are very short lived and don’t provide the extended protection needed against disease.

- Aim for high plant densities (28/ft2 to 35/ft2) to minimize tillering and encourage main stems.

- CPS has much larger seeds compared to HRS. CPS ranges 39 to 55 tkw versus HRS ranges 31 to 45 tkw. Seeding rates of 160 to 180 lbs/ac not unusual.

- To meet 11.5% protein in CPS you aim for 1.75 lbs/N/bu versus 2.5 lbs/N/bu for HRS. For example: 1.75 lb/N/bu × 80 bu/ac = 140 lbs/N/ac - soil N - OM nitrogen

- I like the varieties 5700PR, 5702PR, AC Foremost and AC Crystal. If you’re pushing nitrogen and yields over 100 bu/ac, then 5700PR and AC Foremost have great standability.

- Look up the CPS variety comparison chart here.

If you look at the cost of growing high protein HRS versus CPS wheat, you’ll notice that they are basically the same, depending on whether you normally pencil in a fungicide or not with HRS. I’m confident we can achieve a 15-20% yield increase over HRS wheat with an agronomy program that includes the right variety, plant population, fungicide and fertility. In my opinion, if you don’t normally produce wheat with protein above 12.5% or typically grade less than a No. 2 HRS, then CPS may be a fit on your farm this year. SL

2012 Costs of Production

Shocking fertilizer prices shuffle top five net margin crops

I’ve reviewed this year’s cost of production for our farm and it looks like variable costs will be 16% higher than 2011 while grain prices have fallen 10-15% lower. The biggest sticker shock for most is fertilizer prices which have climbed 33% amidst falling grain prices. After running some scenarios, I found the top five crops to grow based on net margin are, in descending order, flax, malt barley, durum wheat, CPS wheat and HRS wheat. Canola is ranked in sixth place. I’ve included the link here to our cost of production spreadsheet to show the yield and price values I’ve used.

Unfortunately, soil moisture levels are sitting well below average coming into spring with just an inch of moisture in the top foot, possibly two inches in the top two feet. I know that many producers now have 33% of their crop rotation into canola which makes a big difference in overall costs when you factor in seed and fertilizer alone at $130.00 an acre. Flax looks good on paper but moving it is a different issue, never mind the patience to grow it. Malt barley acres will definitely be on the increase and possibly durum too. It’ll be a toss up between CPS and HRS acres. SL

Liquid urea the best option to boost wheat protein

One of the most challenging things in wheat production is matching high yields with high proteins. For my regular subscribers, you know we’ve talked about the use of liquid urea at later growing stages (flowering and milky dough) and how to make liquid urea but have yet to fine tune nitrogen rates and water volumes. Interestingly enough, I recently came across some research from Alberta Agriculture in 1997 stating that foliar applied urea at flowering was more efficient at increasing protein in wheat compared to nitrogen applied prior to seeding. What happened to that study initiative and why hasn’t more been published on this topic?

One of the most challenging things in wheat production is matching high yields with high proteins. For my regular subscribers, you know we’ve talked about the use of liquid urea at later growing stages (flowering and milky dough) and how to make liquid urea but have yet to fine tune nitrogen rates and water volumes. Interestingly enough, I recently came across some research from Alberta Agriculture in 1997 stating that foliar applied urea at flowering was more efficient at increasing protein in wheat compared to nitrogen applied prior to seeding. What happened to that study initiative and why hasn’t more been published on this topic?

I’ve focused on the use of liquid urea versus UAN to boost wheat protein because it is not caustic and won’t rust equipment. It’s more efficient and cheaper than UAN and it requires less product than UAN to produce protein. Lastly, liquid urea doesn’t rely on rainfall to wash nitrogen into the plant.

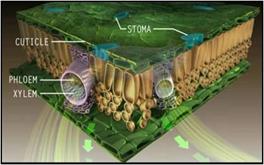

Liquid urea is more efficient because it has a very small molecular size, a neutral charge and is readily absorbed into the plant through the stomata and ectodesmata. UAN or broadcast urea must be washed into the ground and then taken up by plant roots, making them completely reliant on rainfall which something impossible to count on. Below is some research I’ve pulled together on the application of foliar urea on wheat protein.

Research

- Gabala et al. (2003), 9 lbs/ac of urea as a liquid during flowering increased wheat protein from 10.2 to 11.8%

- Johnson and Perfine (2002), 9 lbs/ac of urea as a liquid at milky dough increased wheat protein from 9.9 to 10.8%

- Svenson et al. (2002), 11 lbs/ac of urea as a liquid at doughy stage increased wheat protein from 11% to 12.2%

- Mckenzie et al. (1997), work in southern Alberta with irrigated wheat found the same protein content was obtained with a 4 lb/N/ac applied as liquid urea compared with 89 lb/N/ac of 34-0-0 applied to the soil.

It doesn’t take Steve’s quick math to determine a $2.85 an acre investment in 10 lbs of urea plus application to realize the potential revenue gain from a 1% increase in protein. You’re easily looking at a 3:1 or 4:1 return on your investment if the rates and water volumes are tuned correctly. I’ve queried my Nuffield network to provide you with a few tips on applying liquid urea in wheat.

Tips and tricks to applying liquid urea

- In wheat, try to avoid spraying liquid urea in heat, drought stress and high evaporation conditions. Higher humidity is better.

- Anything over 20 degrees Celsius is too hot and will lead to leaf scorch. Even straight water can scorch at 30 degrees C. Ideally you want damp and humid conditions. Add more water to the mix if you find leaf burn.

- In order to reduce leaf burn from liquid urea on wheat, try to apply late in the afternoon on cloudy overcast days, with water rates around 10 US gal/ac.

- Some producers will use between 21 and 32 US gal/ac of a 20% liquid urea solution, sprayed onto the crop at the flowering to milky dough stage. The application must be done when it's cool, i.e. early morning or in the evening to avoid scorch. The product can be watered down which also helps reduce any risk of crop damage.

- It can be sprayed on with a standard flat fan nozzle to get good coverage of the heads, compared to streamer bars for putting liquid UAN earlier in the season.

Bottom line, producers need to look at how to fine tune liquid urea applications to boost proteins in their systems. You won’t find a cheaper source of nitrogen than urea, especially one that doesn’t erode fittings and pumps. The trick is to reduce leaf scorch that can occur when applied under the wrong conditions. I think we’ve addressed those above but it’s now up to you to discover the timing. Night spraying for some is an option or whenever you find the highest humidity during the day. For those of you who missed the article on how to produce your own liquid urea please email me and I’ll send it to you. SL

Market News

Technicals

Canola: Nov12: The long term trend is down and the short term trend is up.

Wheat: Dec12: The long term trend is down and the short term trend is up.

Corn: Dec12: The long term trend is down and the short term trend is up.

Soybeans: Nov12: The long term trend is down and the short term trend is up.

Canadian Dollar: Mar12: The long term trend is down and the short term trend is up.

USD: Mar12: The long and short term trends are up.